Is The Low Volatility Market At An End?

2019 can be roughly divided into two market regimes. There were periods of high volatility and market choppiness, notably in June, August, and early October. Then, there were the stretches of low and falling volatility – January through May and mid-October through the end of the year.

It certainly seemed like January of 2020 was setting up to be a part of the low volatility market regime. After all, there really wasn’t much in the way of bad news on the horizon. Interest rates are set to be ultra-low for the foreseeable future. Progress was being made in the trade war with China. And, the U.S. economy was generally looking resilient.

Of course, if the market was easy to predict, there would be no reason to trade (because every move would be priced into all assets already). Part of being an effective trader is knowing that anything can happen at any time. That’s why hedging and risk management occurs.

Sure enough, 2020 has already provided a big surprise with the U.S. killing a key Iranian official. It looks to be the start of much more severe tensions in the Middle East. Military conflict of any kind adds uncertainty to the global financial markets. It’s especially true when the potential war zone is a major producer of the world’s oil supply.

After the Iranian news hit, the price of oil shot up, and stocks fell… but not as much as you’d think. There’s a lot of investors who are bullish right now. Apparently, it’s going to take a lot more than the threat of war with Iran to cause something akin to a correction.

That’s not to say there’s nothing to worry about. If the situation escalates, market participants could change their tunes. There is definitely risk in the market right now, like always, just not as much as you’d think given the media headlines.

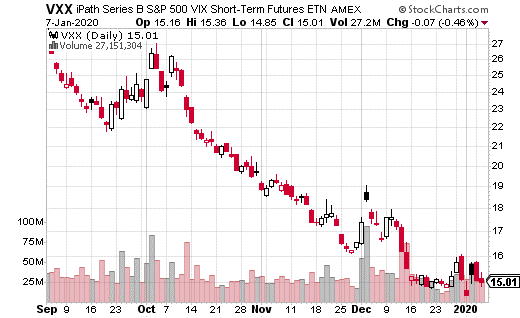

A massive options trade I came across this week basically supports this view. It’s bearish on volatility, but only to a certain extent. The trade occurred in iPath S&P 500 VIX Short-Term Futures ETN (VXX). VXX is one of the most popular methods for trading short-term volatility.

A well-capitalized trader put on a trade called a put frontspread or put ratio spread. This is a put spread where more puts are sold than purchased. In this case, the trader bought the February 21st 14 puts while selling double the 13 puts in the same expiration (with VXX at $15.22).

Here’s what is interesting…

The trade was made for even money. That is, selling twice the 13 puts canceled out the premium paid for the 14 puts. The trade was executed 16,200 by 32,400 times, meaning the zeroed-out premium was over $1.4 million.

By paying nothing in premium, the trader doesn’t lose any premium if VXX stays elevated above $14 by February expiration. Anything between $14 and $13 is profitable, with the max gain at $13 ($1.4 million). The risk in this trade is if VXX drops below $13. There’s no protection from $13 to $0 for the position.

I like this trade because it costs nothing, and there’s a decent gain potential if volatility continues to fall. However, having uncovered risk below $13 is risky, especially if/when VXX goes through a reverse split. Basically, this isn’t the sort of trade you want to do at home. (Besides, margin requirements would be prohibitive for most traders.)

However, just doing a normal put spread (buying 14 puts, selling 13 puts 1 to 1) for February is a reasonable alternative if you believe VXX is going lower. It won’t cost all that much, and you can double your money if volatility fizzles out in the coming weeks.

How You Could Turn “Extra Cash” Lying Around Your House into Thousands of Dollars In as Little as 23 Days

Think about all the loose “extra cash” lying around your house right now.

Those few bucks in a savings jar on the top shelf of the closet…

That annoying change weighing down your wallet…

Wherever the money is — and we all have some sitting somewhere — you’re about to discover how to turn this little extra cash… maybe it’s $100… maybe even $500 into potentially hundreds, even thousands of dollars in as little as 23 days.

Category: Options Volatility Watch