3 Tech Stocks To Play Ahead Of Earnings

Reduce risk into earnings for AAPL, MSFT and AMD stock

Tech stocks are running into earnings season with big profits in the bag. Sector leading companies like Apple (NASDAQ:AAPL) and Microsoft (NASDAQ:MSFT) have generated double-digit gains since their last quarterly reports. Shareholders’ hopes are running high that the upcoming earnings will be good enough to keep the rally alive. Today I want to share an easy options strategy that offers protection ahead of the event.

The risk for many Nasdaq components is that they’ve risen too far too fast, and earnings won’t be good enough to justify the rapid ascent. Any kind of misstep and the froth could quickly come out of the juiced-up share prices. While I think the odds of an outsized drop is small, it’s still worth considering how to reduce risk ahead of the next report.

Selling calls against your shares offers modest downside protection while still keeping you open to additional profits if tech stocks climb higher after the event. The covered call strategy is a no-brainer if you’re willing to limit your profit potential in exchange for grabbing some protection.

Let’s take a closer look at how to deploy these on a handful of popular tech stocks.

Tech Stocks to Play Ahead of Earnings: Apple (AAPL)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

Earnings Date: Jan. 28, after market close

Apple stock has rallied 29% since closing at $243.26 ahead of October’s earnings report. And while the earnings growth may justify the boon, any misstep could quickly give back gains. To obtain protection, I like selling the Feb $330 calls for around $4. You’ll short one call for every 100 shares owned. The $4 per share or $400 per contract received will serve to offset any losses in the stock between now and Feb expiration.

In exchange for the $4 payment, you obligate yourself to sell the stock at $330. The promise limits any further growth in your shares past $330. But that’s still $15 away, so you have another 5% upside if AAPL reacts favorably to earnings.

Microsoft (MSFT)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

Earnings Date: Jan. 29, after market close

Microsoft stock is up 20% since closing at $137.24 in front of last quarter’s report. Historically, MSFT hasn’t been a massive mover on earnings, so I’m not expecting any fireworks, but reducing risk ahead of any uncertain event is smart. With the stock at $164.50, I’m eyeing the Feb $170 calls. You can sell them for $1.95 to obtain as much in protection.

On the profit side, you have room to participate until $170. At that point, you’re obligated to sell your shares, thus foregoing any further gains. Adding the call premium to the additional $5.50 of upside in the stock yields a max potential profit of $7.45 or 4.5%. If that seems like a fair trade, then consider selling one Feb $170 call for every 100 shares owned.

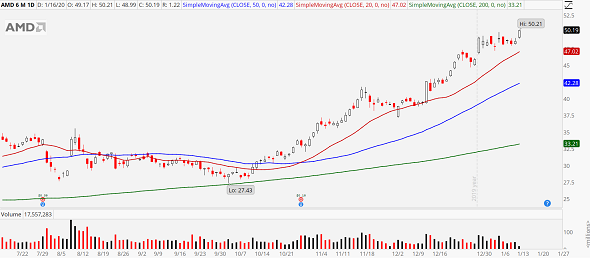

Advanced Micro Devices (AMD)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

Earnings Date: Jan. 28, after market close

Our final highlight is the biggest gainer of them all — Advanced Micro Devices (NASDAQ:AMD). Since closing at $33.69 ahead of its October report, AMD stock has gone on to gain 48% this quarter, bringing delight and big-league profits to shareholders along the way.

Obviously, a mountain of future profit growth is being rapidly priced into the stock. And the looming earnings release may very well deliver. But if it doesn’t, a swift unwinding could be in store. Selling calls to reduce risk seems prudent.

Sell the Feb $55 calls for $1.44, one for every 100 shares owned. This obligates you to sell your shares at $55, but with the stock currently at $49.75, that’s still another $5.25 of upside, plus the $1.44 of cash received. All told, you could capture another 13% if AMD runs past $55.

As of this writing, Tyler Craig didn’t hold positions in any of the aforementioned securities.

See Also From InvestorPlace:

- 3 Standout Oil Services Stocks to Buy

- 9 Up-and-Coming Small-Cap Stocks to Watch

- 7 Energy Stocks to Buy on the Resurgence of the Oil Boom

Category: Options Trading Strategies