Will Stocks Continue To Rally Despite The Coronavirus Scare?

The stock market can be a crazy place. The unpredictability of the financial markets is what makes them so exciting and challenging for traders (and investors). While the long-term direction of stocks has always been up, there are definitely significant periods of volatility over shorter time frames.

For instance, this year we’ve already had a fairly substantial selloff due to fears of the coronavirus and its spread. And, we’ve already seen the market bounce back despite no clear end in sight for the highly contagious virus.

Given the very real possibility of an economic slowdown (albeit temporary) due to the coronavirus, why has the market been so quick to discount the news?

First off, China announced its central bank has injected a massive amount of liquidity into the system to help stabilize it. The additional liquidity could help counter some of the disruptions to the economy brought on by the virus.

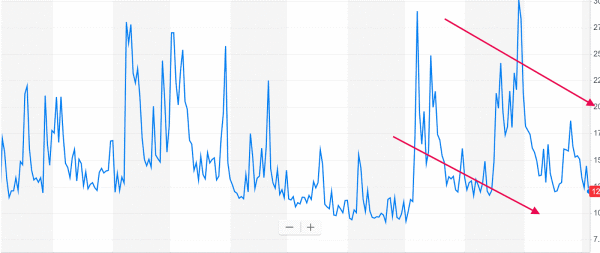

What’s more, the virus appears to be slowing its spread. The data suggest that China is doing a reasonable job of containing the virus with its strict quarantine regime. It’s still early, but there may be signs that coronavirus won’t turn into the global pandemic everyone fears.

Meanwhile, earnings continue to be mostly solid, with big winners such as Amazon (AMZN) leading the way. A short squeeze in a cult stock Tesla (TSLA) has also sent the electric-car maker into the stratosphere.

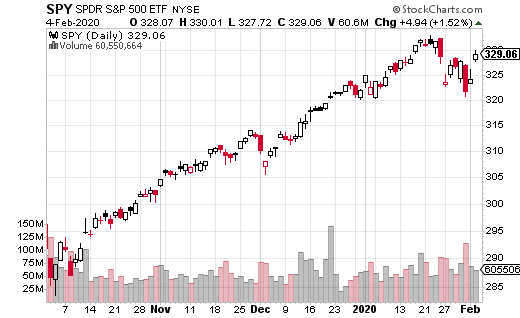

Looking at the options market, there seems to be a fair amount of optimism around future stock prices. For instance, a large covered call trade occurred in SPDR S&P 500 ETF (SPY), which is a moderately bullish strategy.

More specifically, a trader (likely a fund) purchased 1 million shares of SPY for around $330 while selling 10,000 of the June 340 calls for $5.65. That means roughly $5.7 million of premiums were collected on the trade, which works out to a 2% yield in about a 4-month period.

Now 2% doesn’t sound like a lot for a 4-month period, but that’s 6% annualized, which isn’t bad for holding a major index in the era of ultra-low rates. Those SPY shares will also collect two dividends during the holding period estimated at $1.57 each.

Moreover, the covered call trade does leave about $10 of possible share appreciation since the short call is at the 340 strike (which is where the gains are capped). That’s only about 3% upside potential, which is why this is a moderately bullish trade instead of an aggressively bullish trade.

On the other hand, the fund making this trade likely would be more than happy to make 3% on the SPY shares, 2% on the short calls, and collect two dividends. There are certainly other ways to trade if all you are interested in is upside potential.

Having a good idea of what your expected returns will be is worth a lot to a fund, especially one that is managing money from outside investors. That’s also why you may want to do this sort of trade in your own account if you are moderate to bullish on the market for the next few months.

This chart could make today the easiest time in history to retire and feel rich while doing it.

Click here for a full explanation.

Category: Options Trading Strategy