3 Oil Stocks That Are Worth Looking Into Now

Yesterday’s plunge in oil stocks creates opportunity

Saber rattling in the Middle East created a roller coaster ride in asset prices this week. Oil prices initially ripped and then rapidly reversed yesterday, ending with a nasty 4% drop. Energy stocks fell across the board in the wake of the whiplash. While the volatility can be fear-inducing, it also brings opportunity.

Today we’ll focus on three ways to play the oil drop.

The energy sector just ended a decade worth forgetting. While the S&P 500 more than doubled, the Energy Sector ETF (NYSEARCA:XLE) finished right where it began. Sure, shareholders received some dividends along the way, but the cash flow pales in comparison to the giant gains had by the broader market.

But the extreme relative weakness has led to low valuations, and that could make energy a pond worth bottom fishing in. Tack on this week’s volatility fit in crude oil, and we have the excuse needed to shine a spotlight on the space.

Here are three smart trades in oil stocks.

Oil Stocks to Play Now: United States Oil Fund (USO)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

Our first idea dispenses with clever derivative plays and goes straight for the jugular. If you think the oil drop presents weakness worth buying, then do so directly with a trade on the United States Oil Fund (NYSEARCA:USO). It’s a product designed to track the short-term movements in oil by holding crude oil futures contracts. Although it tends to lag crude over the long term, in the short run, it’s a pretty good proxy.

That means if oil rebounds in the coming weeks, USO should too.

Yesterday’s sucker punch took the oil ETF below its rising 20-day moving average, but the 50-day is still pointing higher, suggesting the intermediate-term uptrend is intact. Implied volatility jumped this week, breathing new life into options premiums. Let’s build a naked put play to profit if USO sits above $12 a month from now.

The Trade: Sell the Feb $12 puts for 28 cents.

Oil & Gas (XOP)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

An alternate path to profits could be playing a broad basket of oil stocks via the Oil & Gas Explore & Prod. ETF (NYSEARCA:XOP). Stocks in this industry have been decimated over the decade and sit at the low-end of the ten years. While bottom fishing is a dangerous endeavor, we can increase our odds by using high probability options strategies like naked puts and covered calls. That way, we build a position that profits even if XOP treads water or drops a bit further.

December’s rise was enough to turn the 20-day and 50-day moving averages higher, so buyers do control the short-term trend. Wednesday’s whack created a lower-risk entry, and I’m inclined to accept the gift with a naked put play.

The Trade: Sell the Feb $22 puts for 42 cents.

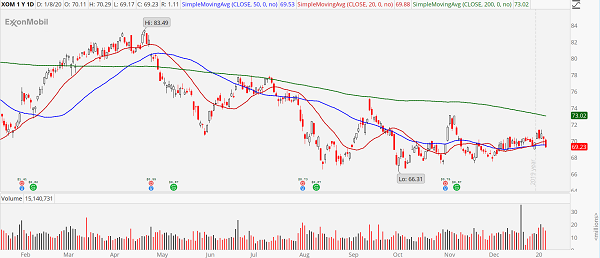

Exxon Mobil (XOM)

Click to Enlarge / Source: The thinkorswim® platform from TD Ameritrade

The final avenue involves trading the juggernaut in the space, Exxon Mobil (NYSE:XOM). It’s a much less volatile pick than my prior two picks and presents a more conservative alternative. Dividend hunters will be particularly happy about this one. The steady drop in price over the decade has boosted the dividend yield to a mouth-watering 5%.

Dividends present a silver lining when bottom fishing. If Exxon stock takes a while before recovering, you still get paid while waiting. XOM stock’s price trend is more neutral than USO and XOP, but implied volatility has been steadily rising, and options premiums are pumped enough to warrant selling them.

The Trade: Sell the Feb $67.50/$65 bull put spread for around 70 cents.

As of this writing on January 9, 2020, Tyler Craig didn’t hold positions in any of the aforementioned securities.

See Also From InvestorPlace:

- 3 Semiconductor Stocks to Buy

- 7 Stocks to Buy That Could Double for a Second-Consecutive Year

- 7 Stocks to Sell to Start the New Year Fresh

Category: Options Trading Strategies