What’s In Store For Chipmakers In 2020?

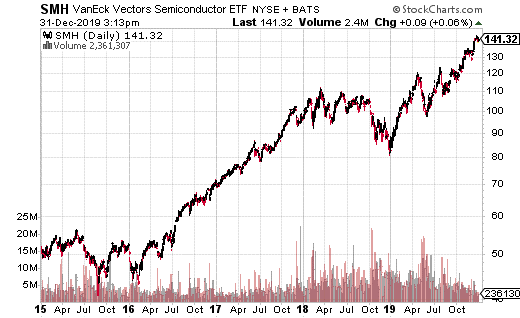

2019 is at an end, and it was undoubtedly a great year for stocks. The S&P 500 was up over 28% for the year. However, semiconductor companies had an even better year. VanEck Vectors Semiconductor ETF (SMH) was up nearly 62% over the same period.

Granted, SMH did plunge sharply at the end of 2018, so it had a lot of room to rally in 2019. Nevertheless, as you can see from the chart, from the summer onward, the ETF basically soared to new highs.

In a nutshell, semiconductors have become an integral part of many of the world’s most demanded products. Chips are necessary for smartphones, tablets, lighting, displays (like TVs, monitors, and other touchscreens), along with the traditional CPUs, GPUs, and memory. In other words, it’s very much a growth sector.

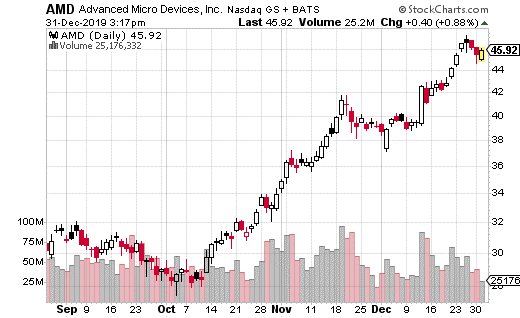

One of the biggest beneficiaries of this boom in chips has been Advanced Micro Devices (AMD). After lagging the competition for years, AMD shot through the roof in 2019, climbing over 146% for the year. The stock went from being a value play to a growth play in a matter of months.

AMD is one of the leading providers of graphics cards (GPUs) in the world. The company made a deal in 2019 to provide products to Alphabet (GOOGL) for its Stadia gaming platform. And the stock took off from there.

You could argue that AMD has gone from undervalued to overvalued. But, it very much depends on your belief in the chip sector. Will it continue to grow in 2020? All current signs point to growth, with consumer spending remaining robust. Still, it’s also hard to imagine the stock can continue to climb at the rate it did in 2019.

Looking at the options market, the action does seem to indicate a slowing in AMD’s climb or perhaps a minor pullback. One trader sold a block of April puts at the 35 strike, perhaps with this view in mind.

The trade was a sale of 2,000 April 35 puts for $0.92 with the stock price at $45.87. The premium collected was $184,000, which is the max gain on the trade. The trade loses money if AMD drops below $35 and stays there at April expiration.

On one hand, this could be considered bullish because if the stock goes up or stays at current levels, the trade reaches max gain (the puts expire worthless, and the trader keeps all the premium). However, it may have a slight bearish tint to it in that the puts were sold all the way down at the 35 strike with the stock over $45.

If the trader was confident that AMD was going to stay above $40, for example, the short strike could have been placed higher. Still, it may just be that the put seller wants to play it safe or is willing to get long AMD at $35 but doesn’t expect it to get that low.

If you don’t mind owning AMD at $35 or want to earn some extra cash because you believe AMD will remain at or near current levels, this trade is a relatively easy one to make in your own account. If you don’t have a margin account, you’ll have to execute a cash-secured put, but that’s not too restrictive since AMD isn’t a high priced stock.

How You Could Turn “Extra Cash” Lying Around Your House into Thousands of Dollars In as Little as 23 Days

Think about all the loose “extra cash” lying around your house right now.

Those few bucks in a savings jar on the top shelf of the closet…

That annoying change weighing down your wallet…

Wherever the money is — and we all have some sitting somewhere — you’re about to discover how to turn this little extra cash… maybe it’s $100… maybe even $500 into potentially hundreds, even thousands of dollars in as little as 23 days.

Category: Options Trading Strategy